Renters Insurance in and around Denver

Welcome, home & apartment renters of Denver!

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Hampden

- Hampden South

- Aurora

- Greenwood Village

- Littleton

- Denver

- Lakewood

- Englewood

- Westminster

- Colorado

- Thornton

- Wyoming

- Arizona

Calling All Denver Renters!

It may feel like a lot to think through family events, your sand volleyball league, your busy schedule, as well as deductibles and savings options for renters insurance. State Farm offers no-nonsense assistance and incredible coverage for your videogame systems, cameras and pictures in your rented apartment. When the unexpected happens, State Farm can help.

Welcome, home & apartment renters of Denver!

Coverage for what's yours, in your rented home

Open The Door To Renters Insurance With State Farm

Renters insurance may seem like the last thing on your mind, and you're wondering if it can actually help you. But take a moment to think about what it would cost to replace all the stuff in your rented condo. State Farm's Renters insurance can help when unexpected mishaps damage your valuables.

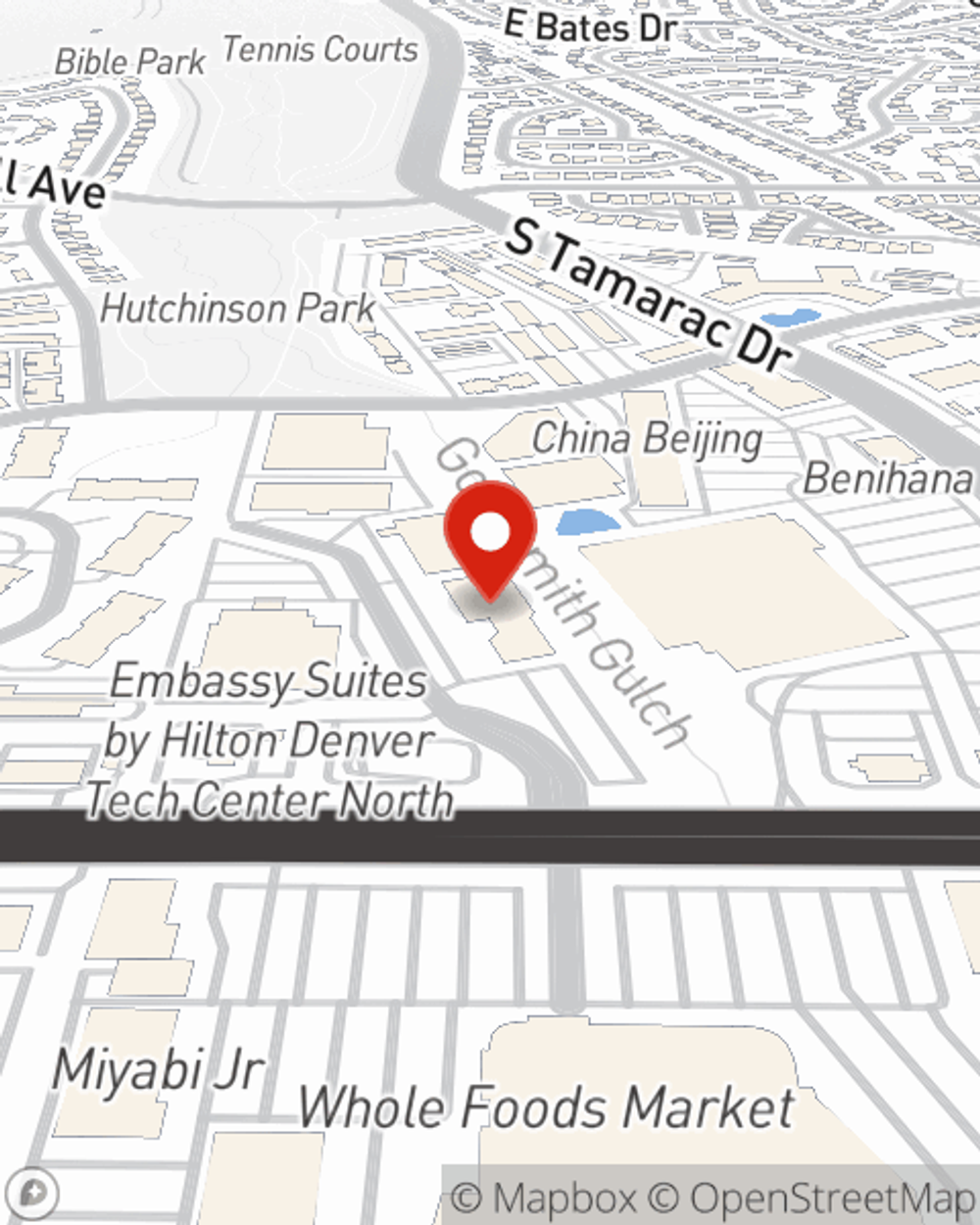

State Farm is a committed provider of renters insurance in your neighborhood, Denver. Contact agent Brady Bower today to learn more about coverage and savings!

Have More Questions About Renters Insurance?

Call Brady at (303) 369-1100 or visit our FAQ page.

Simple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

Brady Bower

State Farm® Insurance AgentSimple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.