Life Insurance in and around Denver

Insurance that helps life's moments move on

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

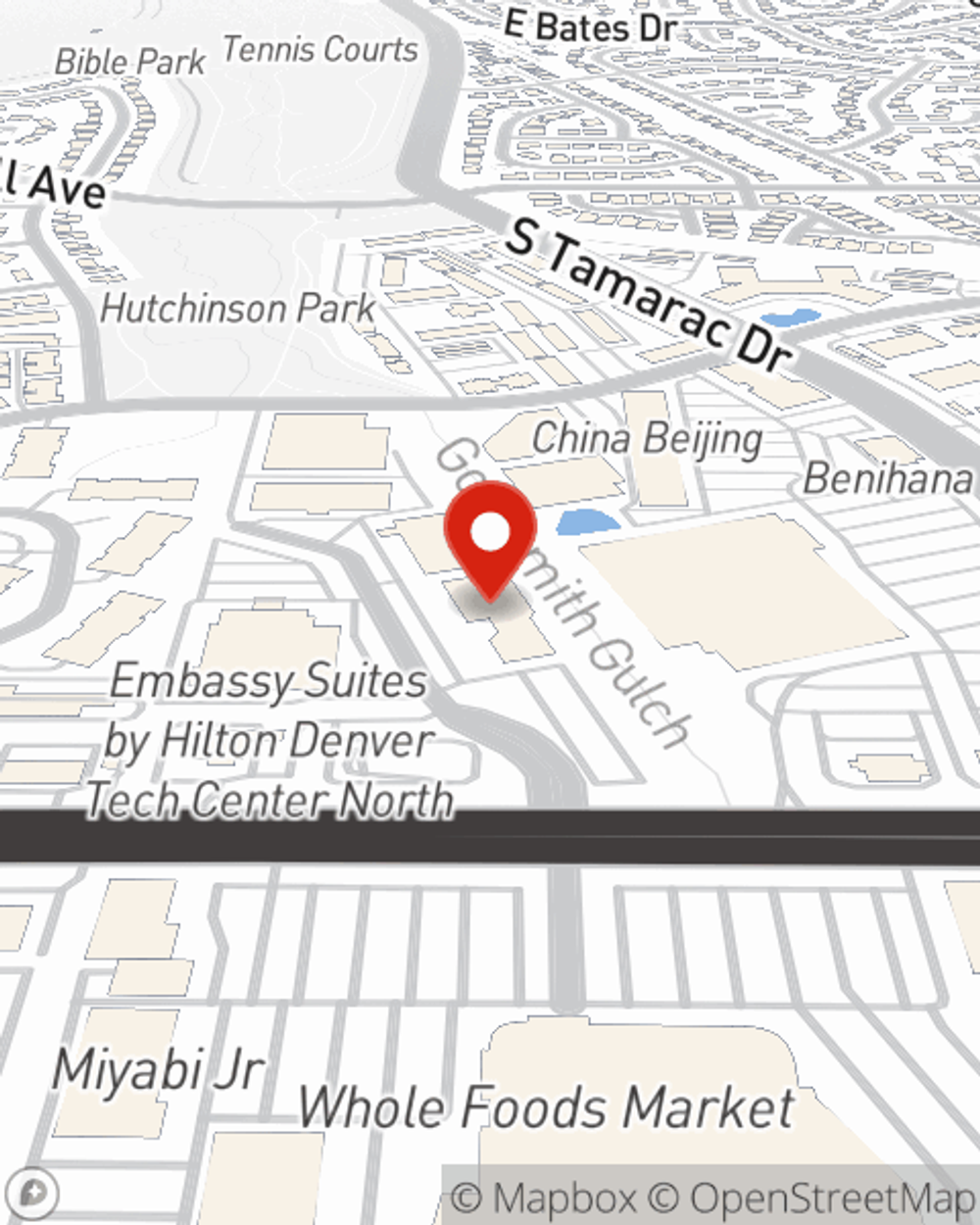

- Hampden

- Hampden South

- Aurora

- Greenwood Village

- Littleton

- Denver

- Lakewood

- Englewood

- Westminster

- Colorado

- Thornton

- Wyoming

- Arizona

It's Never Too Soon For Life Insurance

Investing in those you love is what keeps you going every day. You listen to their concerns help them make decisions, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

Insurance that helps life's moments move on

Don't delay your search for Life insurance

Love Well With Life Insurance

And State Farm Agent Brady Bower is ready to help design a policy to meet you specific needs, whether you want level or flexible payments with coverage designed to last a lifetime or coverage for a specific time frame. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

Simply get in touch with State Farm agent Brady Bower's office today to check out how a State Farm policy can work for you.

Have More Questions About Life Insurance?

Call Brady at (303) 369-1100 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Brady Bower

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.